The act of choosing to lease a home is a significant decision that should not be undertaken in a casual manner. The assessment of the rent-to-income ratio holds significant importance in the context of this decision. The aforementioned ratio plays a crucial role in determining the affordability of a rental property. This article aims to provide a comprehensive explanation of the method used to calculate the rent-to-income ratio, enabling readers to develop a thorough understanding of this significant financial metric.

What Is the Rent to Income Ratio?

It is imperative to have a comprehensive understanding of the rent-to-income ratio (also referred to as the rent-to-income ratio) prior to engaging in any calculations. This monetary indicator plays a crucial role in aiding individuals and households in assessing the affordability of a rental property. The rent-to-income ratio is a commonly used metric to quantify the proportion of an individual’s monthly earnings that is allocated towards recurring housing expenses. Possessing knowledge of this ratio enables individuals to make informed assessments on the allocation and magnitude of rent, thereby safeguarding their long-term financial stability.

The need of establishing an affordable rental rate in proportion to a tenant’s income is of utmost significance. This resource is essential for both individuals seeking rental accommodations and professionals responsible for managing properties. Tenants get a sense of tranquility and assurance, as they are relieved from the burden of accumulating debt in their efforts to meet the financial demands of expensive rent. In contrast, landlords utilize this criterion as a means of assessing the financial stability of prospective tenants, thereby reducing the likelihood of rent delinquency. What is the significance of taking this ratio into account?

Tenant’s Perspective

There are various benefits for the renter when the rent is proportionate to their income:

- Financial Security: You can use this tool to see if the rent you’ve been quoted is reasonable in light of your income and other outgoings.

- Budgeting: You may use the result of this calculation to create a budget that allows for rent to be paid while still leaving room for savings and other extras.

- Avoiding Financial Stress: It’s important to maintain a reasonable rent-to-income ratio so that you don’t find up in a scenario where you can’t afford basic living expenses like food and transportation.

Landlord’s Perspective

The ratio of rent to monthly income is a useful screening measure for landlords:

- Risk Mitigation: The chance of a renter being late or not paying rent increases as the ratio between rent and income rises. This ratio can help landlords reduce their exposure to these hazards.

- Property Viability:Rent-to-income ratios are a useful tool for landlords in determining whether or not their rental properties will attract qualified renters. This aids in establishing reasonable rental rates, which in turn draws in tenants with solid incomes.

- Legal Compliance: Landlords may only charge a certain percentage of a tenant’s monthly income in certain areas. To avoid legal issues, it is crucial to have a firm grasp of these constraints.

Calculating Your Monthly Income

The monthly income figure is the starting point for the rent to income ratio calculation. Multiple sources contribute to your monthly income, including:

Gross Salary

A person’s “gross salary” is their earnings from employment before any deductions for taxes and other expenses. Your gross pay is your total salary before taxes and other deductions are taken out. This number represents your pre-tax income, which influences your ability to pay for living expenditures, including rent, and is therefore a crucial factor to consider when determining your rent-to-income ratio.

Additional Income

Your ability to pay your monthly rent may change dramatically if you get a job or start a side business. Earnings from sources outside than your principal job could include those from side jobs, investments, rental properties, freelancing, and so on. Be sure to include all of these sources of money when figuring out how much money you bring in per month.

Government Assistance

If you or your family are having financial difficulties, the government may be able to help. This aid can take the shape of unemployment payments, food stamps, rent subsidies, or other welfare services. Government assistance should be counted as part of your monthly income rather than as a separate category.

Total Monthly Income Calculation

Simply sum up the amounts in the “Monthly Amount” column of the table to get your total monthly revenue. This figure is your gross monthly income and will be used as a foundational component in calculating your rent-to-income ratio.

Why Is Knowing Your Monthly Income Important?

For several budgeting purposes, like determining what percentage of your salary goes toward rent, it’s crucial to know how much money you bring in each month. A handful of the most important reasons why:

- Budgeting: With an accurate revenue estimate in hand, you can confidently plan for all of your monthly expenses, including rent, and avoid going into debt.

- Rent Affordability: You can determine if a rental property is within your budget by comparing the monthly cost to your monthly gross income. You can use this information to better choose a place to call home.

- Financial Health: One of the best measures of your financial health is your monthly income. It’s a place to begin when thinking about your long-term financial stability and making plans.

Determining Your Maximum Affordable Rent

In the previous piece, we covered the steps involved in estimating your monthly income, an essential component of the rent-to-income ratio. Let’s move on to the next critical step, which is calculating how much rent you can comfortably pay. Rent payments shouldn’t account for more than 30 percent of a household’s monthly income, according to many financial experts. The 30% rule is a common-sense benchmark for success.

The 30% rule is a good rule of thumb for determining whether or not a rental property is within one’s budget. It’s recommended that rent not exceed 30% of one’s monthly take-home pay. This rule of thumb originates from the realization that spending a large chunk of one’s income on rent can put one’s ability to meet other, more pressing financial obligations at risk.

Example:

Let’s use an actual scenario to demonstrate the 30% rule. Let’s pretend your monthly take-home pay is $4,000. You can use the 30% rule as follows to figure out how much rent you can afford:

- Maximum Affordable Rent = Monthly Income * 30%

- Maximum Affordable Rent = $4,000 * 30% = $1,200

Your maximum manageable rent would be $1,200 if you followed the 30% rule. To avoid throwing off your budget, try to keep your rent at or below that amount each month.

Importance of the 30% Rule

There are many reasons why the 30% rule needs to be understood and followed:

| Benefits | Description |

| Financial Stability | The 30% rule is a good guideline for allocating a healthy amount of money toward housing costs. You’ll have less of a chance of living paycheck to paycheck if you follow this technique. |

| Budgeting | When drawing up a spending plan, the 30% rule is a helpful guideline to follow. Budgeting your rent payments in this way leaves more money for things like food, transportation, and savings. |

| Preventing Overextension | If your rent is more than 30 percent of your income, you may be overextending yourself financially. If you follow this advice, you won’t have to worry about breaking the bank or piling up too many housing-related bills. |

| Long-Term Planning | The ability to save for things like a down payment on a house, retirement, or investments depends on maintaining a manageable rent-to-income ratio. It lays the groundwork for realizing your long-term monetary goals. |

Calculating Your Maximum Affordable Rent

Here are the steps you need to take to figure out how much of a rent increase you can afford:

- Calculate your total monthly income, as discussed in the previous section.

- Apply the 30% rule: Multiply your monthly income by 30% to find your maximum affordable rent.

- Consider this number when you explore potential rental homes. To avoid going into debt, it’s best to look for a rental that doesn’t charge more than you can comfortably afford each month.

Calculating Your Rent to Income Ratio

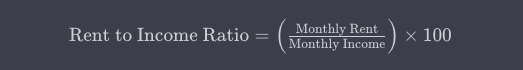

Finding out what percentage of your salary goes toward rent afterward is the next step. The formula reads as follows:

Let’s dissect it with another case in point:

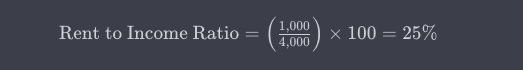

Assume you’ve located a rental property with a $1,000 monthly rent and a $4,000 monthly income.

A 25% ratio of rent to income is reasonable in this situation. In other words, you’re spending less than the recommended 30% of your salary on rent each month.

Interpreting Your Rent to Income Ratio

Knowing what percentage of your monthly gross rent goes toward paying the mortgage or rent will help you make smart housing decisions. Here’s how to make sense of the rent-to-income ratio at various levels:

- Less Than 30%: Congratulations! Your monthly rent is within the suggested amount, therefore you should be in good financial standing.

- 30% to 40%: Even while this is still workable, it may suggest that your rent is eating up a sizable percentage of your income. It’s important to think about the big picture when it comes to your finances and to look for ways to save money on housing.

- More Than 40%: Overspending is possible if your rent is more than 40% of your take-home pay. It’s smart to take stock of your living arrangements and look for ways to reduce your rent.

Conclusion

Learning how to calculate the rent to income ratio is a critical skill for responsible money management and sound rental-choice decisions. If you follow the advice in this manual, you’ll be able to set reasonable housing costs within the context of your overall budget and achieve your financial goals. While the 30% rule might serve as a general rule of thumb, it is important to remember that each person’s housing needs and goals are unique.

FAQs

Is the 30% rule a strict guideline?

The 30% rule is often cited as a benchmark, although it is not an inflexible rule of thumb. Depending on their personal situation, some renters may discover that they are able to devote a larger portion of their salary toward housing. The state of your finances and your top priorities should be taken into account.

What should I do if my rent to income ratio exceeds 30%?

Rent payments as a percentage of gross income should be reduced if the percentage is beyond 30%. You may look for a cheaper place to rent, move in with a roommate, or get a second job to supplement your income.

Are there any online tools to help calculate the rent to income ratio?

Yes, to rapidly ascertain if your rent is affordable, you might use one of several available online calculators. Many variables, like your location and regular bills, are factored into these calculators.

Should I include taxes in my monthly income when calculating the ratio?

Since taxes can vary widely from person to person, it is best to use your pre-tax income (gross income) when calculating your rent to income ratio. The calculation is more reliable and accurate if you use your gross income as the starting point.

Is it possible to negotiate rent with the landlord?

Yes, when the rental market is favorable and you have a solid rental history, you may be able to negotiate a lower rate with your landlord. If you think the rent is excessively high in relation to your income, you should talk to your landlord about it.